ERROL PARKER | Editor-at-large | Contact

“I’m as cunning as a shit house rat,” he said.

“So many of my friends have jumped into property ownership before they were ready. Struggling to pay a mortgage at record-low interest rates. Paying twice as much as they would’ve five years ago,”

“Idiots.”

Oliver Markson is a bright, young and ‘cash-rich’ city worker hellbent on creating his own financial destiny – by any means possible.

Friends told The Advocate that the popular former Whooton School prefect has always had a ‘side hustle’ to generate extra income while he worked as a clerk at his father’s French Quarter legal practice.

However, since sitting down to watch 60 Minutes last night in his parents palatial Betoota Grove home, the full-time-live-at-home son has hatched his own plan to short the property market and make ‘millions’.

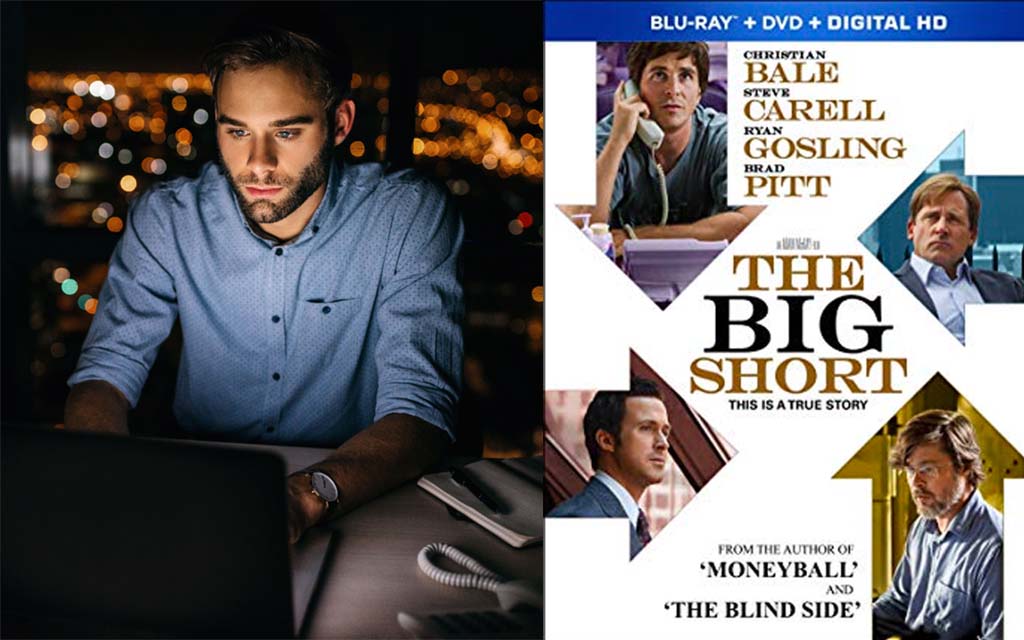

The 29-year-old’s idea stems from his love of ‘The Big Short’ – a 2015 Hollywood film that heavily-dramatises and simplistically regales viewers with three separate but concurrent stories, loosely connected by their actions in the years leading up to the 2007 housing market crash.

“And it’s going to happen here,” he said.

Markson joined our reporter in a French Quarter cafe, where he outlined his scheme to get rich very quickly.

“I’ve amassed almost $50k in personal savings over the past seven or so years. I’m going to use that to short the banks and property-centric businesses such as Domain and Fairfax,”

“I’ve pulled all my other investments out. Resources are going south now, too. That’s often the first sign. In fact, there’s been lots of first signs but nobody, including the banks, wants to take their head out of the sand. When guess what? I have my head out of the sand and I’m going to make it.”

The Advocate reached out to a number of local property owners for comment but none of them really seemed interested.

However, one owner, who asked to remain anonymous, said that he’s just going to see how it goes.

“There’s not much I can do now, is there?” they said.

“Sell my house, lose money on it, then go start renting again? I’d lose a lot of money doing that. I guess I’m just going to have to ride it out, yeah?”

More to come.